Aravinda Electricals Infra – Investor Pitch Deck

A complete investor pitch deck and strategic storytelling project that transformed a deep-tech clean energy innovation into a clear, compelling, and investor-ready narrative.

Overview

Aravinda Infra approached Creative Nexus with a strong technology innovation but a highly complex story.

Aravinda Infra Pvt. Ltd. is driving India’s infrastructure transformation through reliable, future-ready electrical and civil engineering solutions. With 30+ years of EPC expertise, the company has evolved into a scalable, capital-efficient enterprise strengthening power networks and bridging infrastructure gaps nationwide — now reimagined as an investor-ready growth story focused on scalability, opportunity, and sustainable impact.

They needed a pitch deck that could:-

- Simplify a complex engineering + infrastructure + EPC story into a compelling investment case

- Clearly articulate the problem, opportunity, and scalability of Aravinda’s model

- Showcase financial strength, government-backed visibility, and de-risked growth

- Position Aravinda Infra as a venture-ready infrastructure leader driving India’s next phase of power transformation.

The Challenge:

This project required strategic clarity and narrative alignment across multiple fronts

Public-sector infrastructure fundraising is a highly regulated, competitive, and relationship-driven space. The agency needed to translate Aravinda Infra’s 30-year EPC legacy into a modern, investor-ready story — one that balanced credibility with ambition.

The deck needed to balance:

- Technical depth without overwhelming non-engineering investors

- Market opportunity without overgeneralizing government-driven demand

- Growth narrative while maintaining fiscal discipline and proven execution

Additionally:

Public-sector projects often have long tender cycles and complex payment structures, demanding a story that reassures investors on cash flow and risk management

The leadership team’s execution pedigree needed to be reframed as a scalable, capital-efficient model

The story had to resonate with investors, government stakeholders, and strategic partners alike

There was no existing communication framework that captured this duality — legacy strength and future scalability — in a clear, investable form.

our approach

01/ STRATEGIZE & SIMPLIFY

We decoded Aravinda Infra’s complex EPC, civil, and electrical expertise into a clear, investable narrative. This meant identifying key differentiators — execution track record, reliability, and government-backed projects — and aligning them with investor expectations.

STORYTELL & STRUCTURE

We built a compelling storyline that connected legacy, scale, and impact. By integrating data, milestones, and financial insights, we crafted a growth-focused narrative showcasing profitability, scalability, and public-sector credibility.

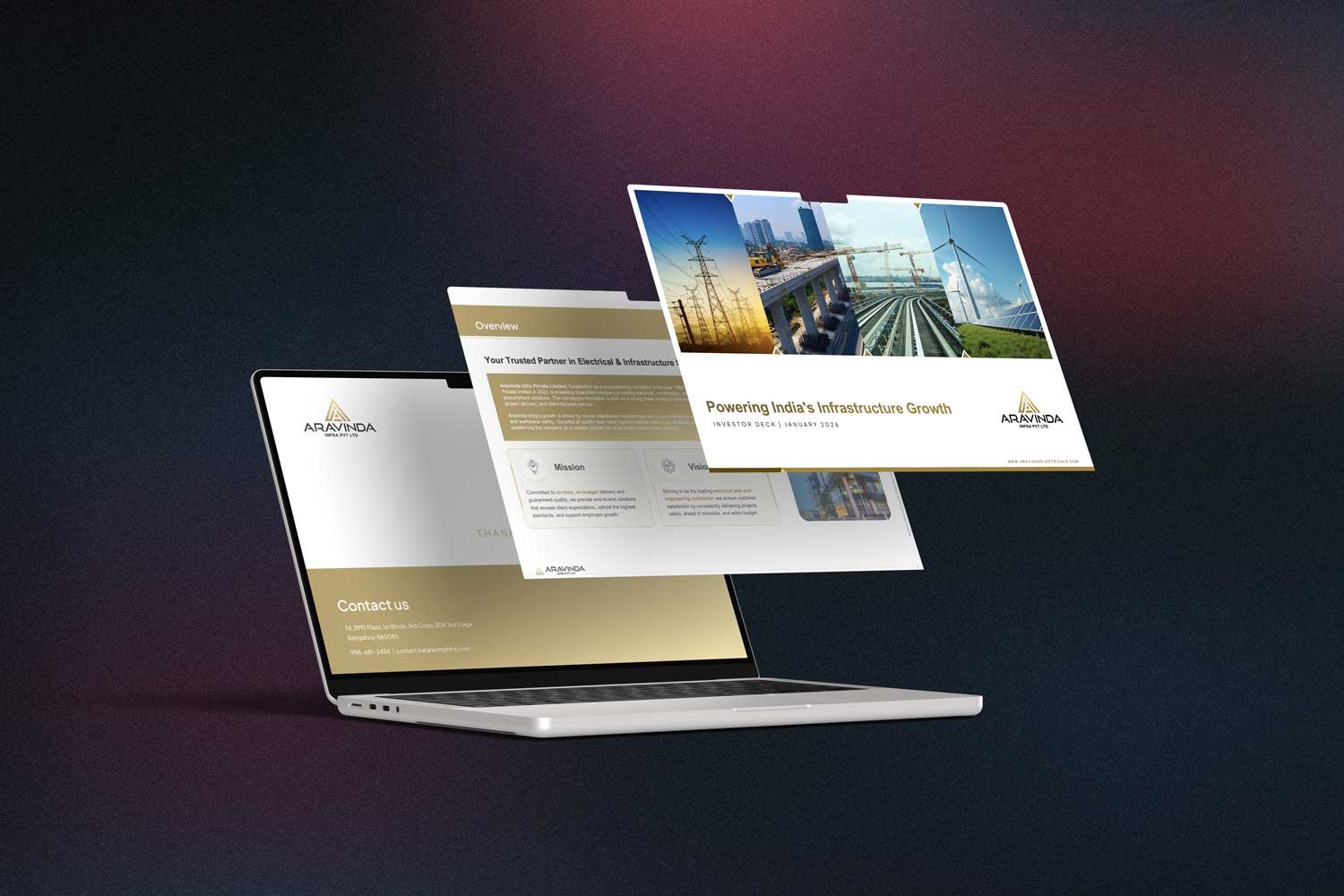

DESIGN & DELIVER

We transformed the story into a visually striking, investor-ready pitch deck — balancing technical precision with emotional appeal. Every slide was tailored to build confidence, simplify complexity, and inspire capital commitment.

The Results

The final outcome was a high-impact investor pitch deck that:

Aravinda Infra now stands with a strong foundation to:

- Drive active fundraising and strategic partnerships

- Expand presence across high-value infrastructure projects

- Sustain long-term credibility through transparent, growth-driven storytelling

Impact at a Glance

- Clear articulation of a ₹ trillion+ infrastructure opportunity

- Proven execution with government-backed projects and zero payment risk

- Investor-ready narrative highlighting scalability and financial discipline